Part A (Hospital Insurance) helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

Part B (Medical Insurance) helps cover services from doctors and other health care providers. It can cover durable medical equipment (like wheelchairs, walkers, hospital beds). Part B covers many preventive services (like health screenings, shots or vaccines, and yearly “Wellness” visits.

PROS: People with Original Medicare can go to any doctor or hospital that takes Medicare, anywhere in the U.S. In most cases, there is no need for a referral to see a specialist.

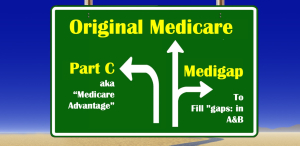

CONS: You’ll likely want to pay for a Part D prescription drug plan to cover costs. There are deductibles and co-pays that you’ll have to pay. These can be covered by a separate Medicare Supplement (or Medigap) policy.

Medigap Fills The “Gaps” In Medicare Parts A & B

Click to find lowest cost Medigap plan in your State

Over 14 million people have purchased separate insurance to fill the ‘gaps’ in Medicare. A Medicare Supplement (commonly called Medigap) pays for covered charges that Medicare doesn’t pay for.

For example, a Medigap policy can pay the Medicare deductible and any required co-pays. People like Medigap because they can see any doctor or use any hospital that accepts Medicare.

There are no limits or constraints (such as those with Medicare Advantage). Want to see a specialist, you can. The Mayo Clinic, it’s okay.

Costs for Medigap insurance can vary considerably for equal coverage. For example, in parts of Iowa, a woman turning age 65 can buy Plan G for $79-per-month. She could pay as much as $192 for Plan G from a different insurance company. It’s really important to compare.

Medicare Advantage (Part C)

They call it Medicare Advantage (MA) but really it’s private insurance. That’s not necessarily bad. But it’s important to understand the pros and cons of Part C coverage. Over 26 million Americans have Part C coverage (2022).

Part C plans provide the benefits of Medicare Parts A, B, and often Part D (drugs). Sometimes there is no premium charge. There may be lower co-pays, so there’s no need for Medigap. Many offer added benefits not in Original Medicare, such as fitness classes or some vision and dental care.

The TV ads make Part C plans sound great. But be wary. Advantage plans can limit who you get your medical care from. They can carry hidden risks, especially for people with major health issues. If you live in a rural area, there may not be many plans to choose from.

Advantage plans typically require that you get care from a more limited network of providers. You may need pre-authorization to see a specialist.

Advantage plans typically require that you get care from a more limited network of providers. You may need pre-authorization to see a specialist.

A Kaiser study found that about half of all MA enrollees would end up paying more than those in traditional Medicare for a seven-day hospital stay.

The average Medicare beneficiary can choose from 43 Medicare Advantage plans (2023). That is an increase from prior years.

Finding the best plan can be difficult. Many agents today offer both MA and Medigap. Those that do will say so on their agent directory listing.

Tips For Finding The Best Medicare Plan For You

Medicare is a NATIONAL program. But your plan options typically are LOCAL. You may have as many as 40 different Medicare Advantage (Part C) plans to choose from. Add to that as many as 20 different Medigap options and 20 different Medicare Part D prescription drug plans.

Agents – Brokers – Call Centers: You can not buy Medicare insurance directly from an insurance company or provider. You must always speak to an agent (licensed insurance agent).

Five Tips For Consumers

TIP #1: Know the difference. An agent typically is able to sell you coverage from just one company. A broker usually can sell you plans from multiple companies. And, the person answering your call to a toll-free Call Center number generally will have a plan they’d like to see you buy.

Tip #2: How to determine the difference. Ask the person how many companies they are ‘appointed’ with. Appointed is insurance industry jargon for “I can sell that plan and earn a commission or fee when I do”.

Tip #3: Ask which companies the person can offer you. The better Medicare insurance brokers will typically be appointed with a few of the top sellers. But maybe not all. That’s why it’s important top ask which plans they can represent. If one or two are missing, you might want to get a comparison quote from another broker.

Tip #4: It’s worth speaking to at least 1 local pro. Medicare plans are local and a local Medicare insurance agent will know which plans people in your area like. And, which plans people are dropping because of problems. The Association provides a free and private directory you can use to find pros in your Zip Code.

Tip #5: Ask about your rights to change plans. Medicare plans change all the time. Some get better and some get worse. Medicare gives you certain rights to change plans. But that’s not always the case. So ask before you sign on the dotted line. And remember, verbal statements are worthless when it comes to insurance. Only things in writing matter.

Medicare is an incredible program with many significant benefits for 64 million Americans. But, it’s very complex. And you will have to make multiple important decisions in order to find the best coverage for your specific needs and budget.

Medicare is an incredible program with many significant benefits for 64 million Americans. But, it’s very complex. And you will have to make multiple important decisions in order to find the best coverage for your specific needs and budget.

Advantage plans typically require that you get care from a more limited network of providers. You may need pre-authorization to see a specialist.

Advantage plans typically require that you get care from a more limited network of providers. You may need pre-authorization to see a specialist.